The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen.

12:14 pm

SPX was repelled at the 50% retracement level at 6813.76 this morning, then restarted its decline. This may have occurred at the behest of the dealers trying to nudge the SPX into long gamma territory above 6800.00. SPX has since declined to the 52-day Moving Average at 6764.17. A drop beneath it may result in the SPX going into a much steeper decline.

8:00 am

Good Morning!

SPX futures bounced this morning to retest the 52-day Moving Average at 6763.75, rising to 6756.60 thus far, before resuming its decline. The stage is set for a potentially powerful decline toward the 1987 trendline near 6000.00 in the next week. There is likely to be a Christmas bounce, but the Santa Rally is past. The real panic may begin beneath the neckline at 6521.92.

Today’s options chain shows Max Pain at 6765.00. Long gamma rests above 6800.00 while short gamma resides beneath 6750.00. Options are off to a bearish start.

ZeroHedge records a tap on the brakes, “Stocks rebounded from Wednesday’s tech-led rout after an upbeat forecast from Micron helped put the brakes on a tech-driven selloff on a busy day for data and central bank meetings.”

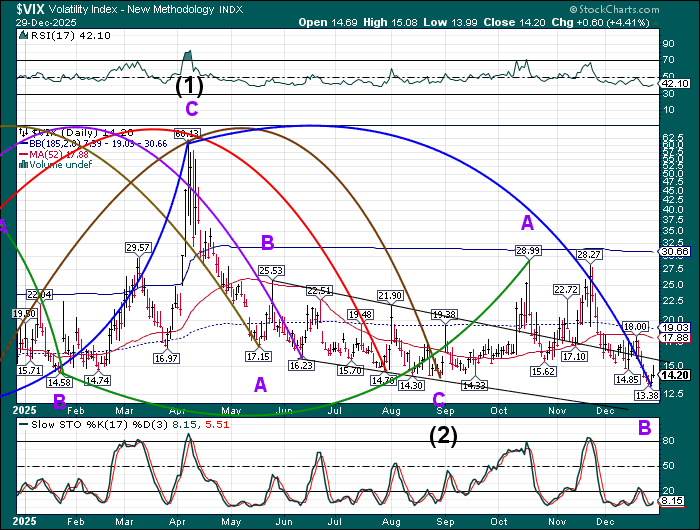

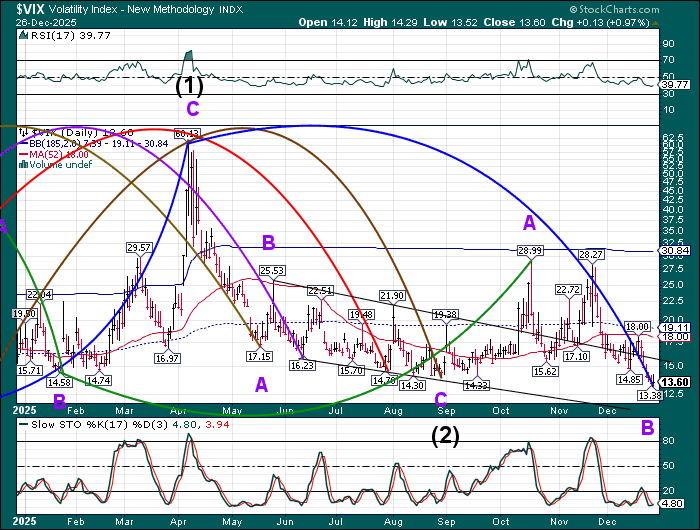

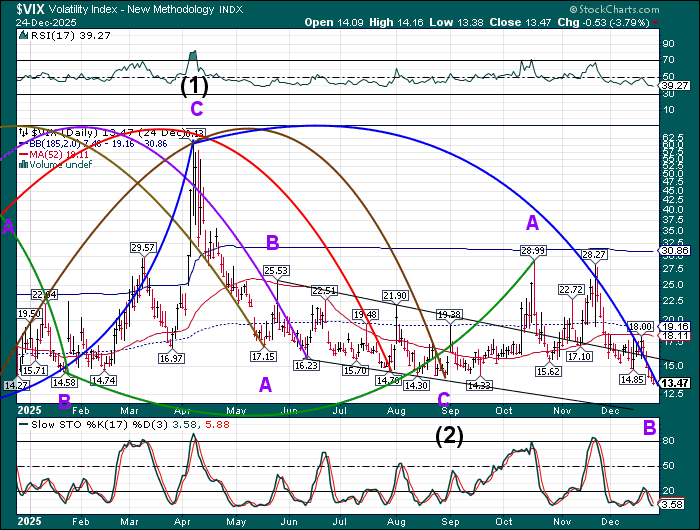

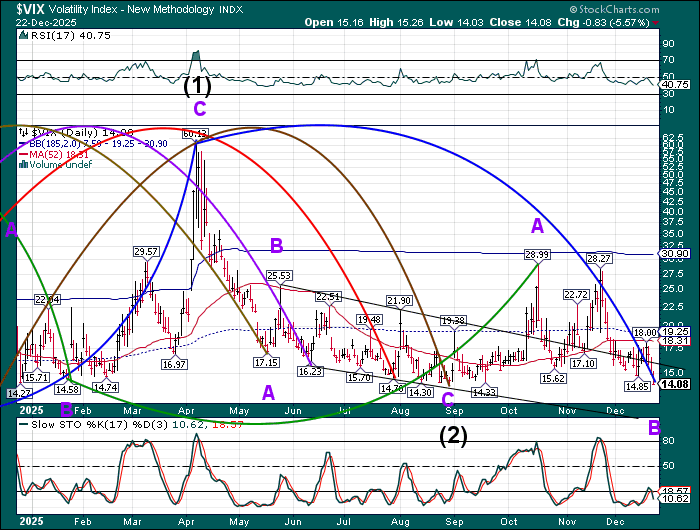

VIX futures slid to 16.93, remaining above the trendline near 16.30. It remains poised to break out above the 52-day Moving Average at 18.38. The next resistance is the Cycle Top at 30.93. Once above that the nest resistance is the April 7 high at 60.13. VIX may be in a period of strength today that may extend several more days.

The December 24 options chain is locked in a ferocious tug of war with Mas Pain at 16.00. Short gamma is losing strength while long gamma bursts on the scene at 17.00, with strong outposts of institutional investors every 5 points above 20.00, stretching to 35.00.

USD futures have made their Master Cycle low on Tuesday and are lingering near (retesting) their low. The mid-Cycle resistance is close by at 98.85 and the 52-day Moving Average is at 99.21. The Cycles Model proposes a burst of energy over the weekend that may propel the USD above all resistance levels. Once accomplished, the next target level may be 104.00 or higher. The initial breakout may last to early January.

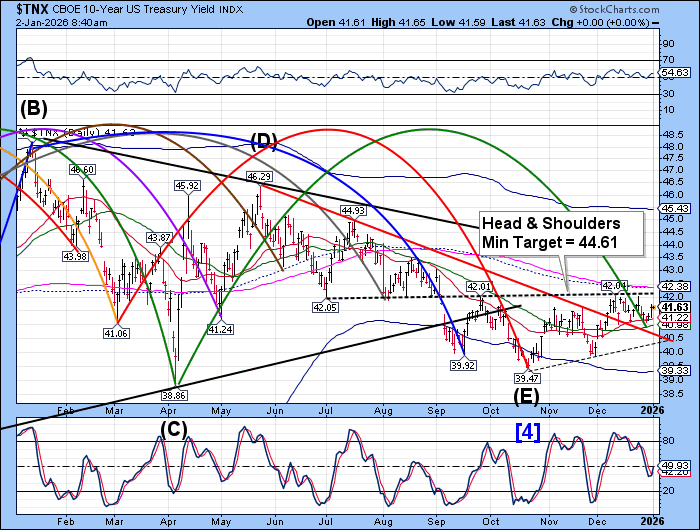

TNX futures have made a morning low at 40.96 thus far. this morning., testing the descending neckline and potentially making a Master Cycle low. It may yet decline to the 52-day Moving Average at 40.83 before a reversal is made. Today is a powerful reversal day, so stay tuned for that event.

ZeroHedge reports, “‘A grain of salt’ is how many have described their position on this morning’s government shutdown-delayed release of October and November Consumer Price Inflation data.

Headline CPI slowed to 2.7% YoY in November (dramatically below the 3.1% YoY expected)”

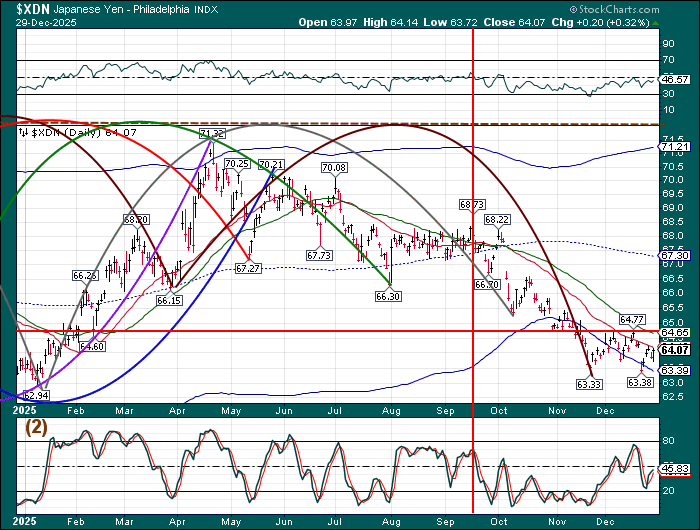

The Japanese Yen is declining in a half-Cycle low, thus far at 64.11, possibly to the Cycle Bottom at 63.73 today or tomorrow. However, a breakout may be imminent as the Bank of Japan raises its benchmark interest rate. Trending strength appears next week and may redouble its effect through the year-end.

Mainichi.jp reports, “TOKYO (Kyodo) — The Bank of Japan is widely expected to raise its benchmark interest rate from around 0.50 percent to around 0.75 percent, its highest level in 30 years, at its two-day policy meeting starting Thursday, as inflationary pressures remain elevated due in part to the yen’s weakness.”

Bitcoin rose to test Intermediate resistance at 89909.00. this overnight. It has eased down since then and may be declining beneath the Cycle Bottom at 87910.00. The Cycles Model suggests the “bottom may drop out” over the weekend. A Master Cycle low may be found by the end of next week.

9:42 am

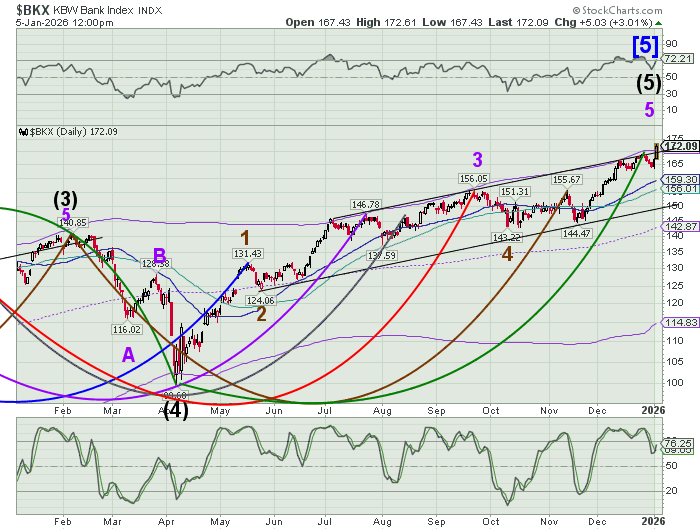

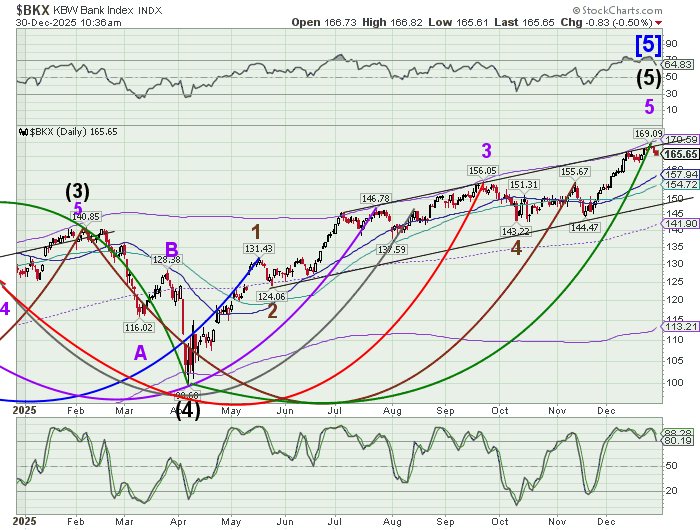

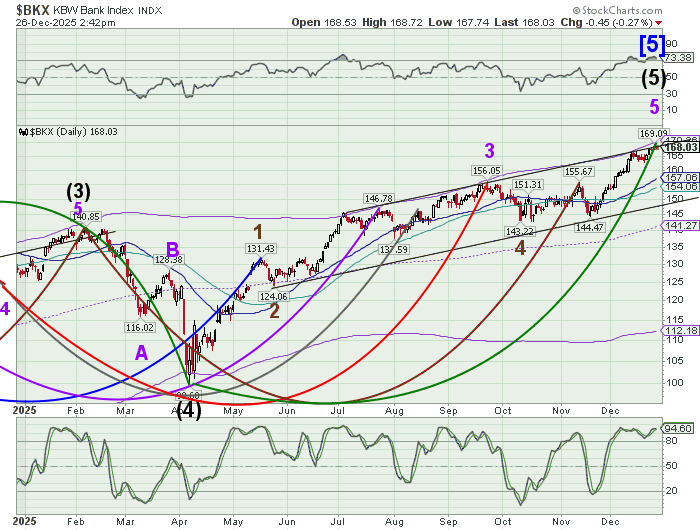

BKX is consolidating beneath its trendline at 165.00 and its Cycle Top at 168.45. It is on an aggressive sell signal. This signal may be “for real” as the Bank of Japan raises its benchmark interest rate from .50% to .75% tomorrow. It may not seem like much, but consider that the is a 50% increase of the benchmark rate, not seen in 30 years! Banks and other financial institutions have relied on the “nearly free” Yen carry trade to borrow money in massive quantities to leverage treasuries and other securities to produce gains on very thin margins.

Today troubled banks are being propped up financially through REPO. The Secured Overnight Finance Rate (SOFR) is at 3.69%. This is the cost of money to troubled banks. At the same time, healthy bank deposits are paid as little as 0% to 1%, with time deposits earning higher rates. This can be lucrative for banks who have a good customer loan portfolio earning 6-10%. However, when the economy slows down, deposits evaporate and loans are often unpaid or in default, forcing banks to go to the REPO window to stay afloat. One such bank has withdrawn $158 billion from the Federal Reserve coffers, as a result, the Fed reserves fell beneath $3 trillion, causing reserves to become “scarce.” That is why the Fed had to cut its rate to 3.75% and restart QE early to refill its reserve.

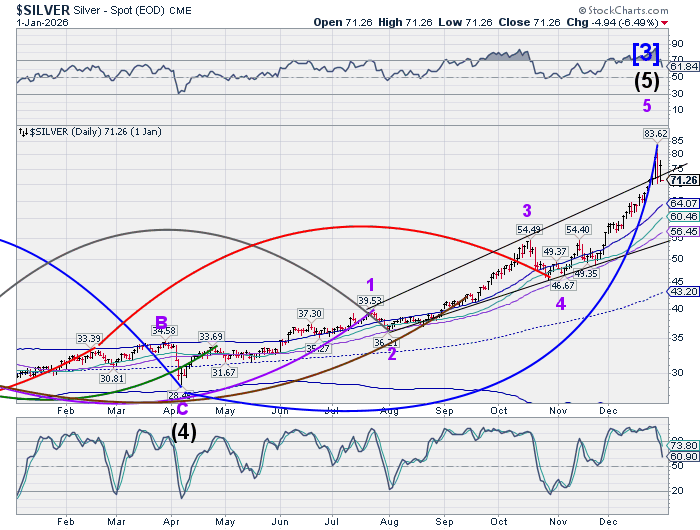

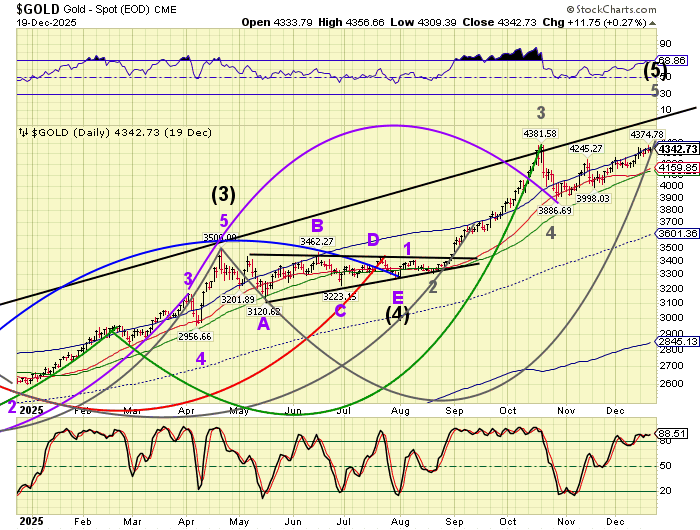

Silver futures have stepped back to a low of 64.69 this morning from yesterday’s Master Cycle high at 66.88. This pause in the rally may cause profit taking and a further reversal. The Cycles Model suggests that silver may correct to as low as the mid-Cycle support at 41.32 in the next several weeks. The real parabola has not yet begun.

ZeroHedge observes, “Parabolic

Silver trends have become steeper and stepper. (sic)”